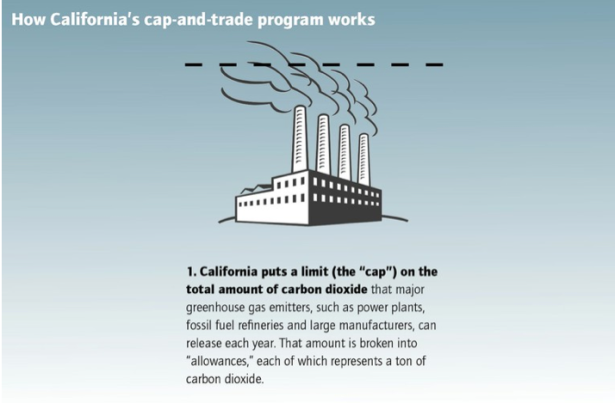

Image: first of a three-part infographic about how California’s cap and trade program works. Designed by Andy Cullen and copyright High Country News.

This year, California rolled out an economy-wide carbon cap and trade program, the first of its kind in the U.S. There is a lot riding on the success or failure of this program, not least because California is the ninth largest economy in the world and is going it alone with cap and trade in the U.S. The Golden State also has a legacy of introducing pioneering environmental legislation that other states and eventually the federal government adopt.

In my latest story for High Country News, I write about how the state has designed the program to avoid the mistakes of the European Union’s carbon trading scheme, which has suffered from overallocation of carbon credits and subsequent slumps in the carbon price.

The story also highlights the concerns of a major steel producer, California Steel Industries, which, like other businesses, is concerned about finding cost-effective ways to reduce its carbon emissions as the carbon “cap” tightens in future.

Here’s an excerpt:

The Golden State forged ahead with the carbon dioxide cap-and-trade program despite the U.S. Senate’s 2010 failure to pass a national program. Given the state’s history of implementing environmental regulations that later become national policy, a successful cap-and-trade system could serve as a federal model. If cap-and-trade in California “fails, or is perceived to have failed, then that could be the nail in the coffin for cap-and-trade consideration as a policy instrument in Washington,” says Robert Stavins, a Harvard professor who studies climate policy.

While its overall impact on U.S. emissions won’t be major, the California experiment makes several improvements to existing cap-and-trade strategies. It covers more sources of pollution than the five-year-old Regional Greenhouse Gas Initiative in the Northeastern U.S., which applies only to power plants. The European Union started the world’s largest carbon cap-and-trade program in 2005, but it had a significant flaw: the initial stage of the program gave away too many free credits, resulting in some power companies raking in windfall profits by raising electricity prices even though they didn’t have to pay for their allowances. It also contributed to low prices for carbon allowances, which provides scant incentive to cut emissions.

Mary Nichols, head of the California Air Resources Board, the agency steering the state program, is confident that California’s effort will be different. The program covers 360 businesses, which represent about 600 facilities that each release more than 25,000 metric tons yearly — enough to put a big dent in California’s total carbon output. The EU’s difficulty, Nichols notes, was that authorities didn’t have an accurate measure of the total quantity of emissions initially. California, though, has had a greenhouse-gas reporting requirement in place since 2008.

Full article at High Country News.

One thought on “California’s carbon market may succeed where others have failed”